By Tom S. Lee, Ph.D., Founder & CEO SA Ignite

By Tom S. Lee, Ph.D., Founder & CEO SA Ignite

Twitter: @saignite

Did you know the VBM applies to MSSP ACOs this year? Or that as few as 3% of your providers can affect your total score by as much as 50%? Or more importantly that VBM quality and cost performance will constitute up to 60% of a provider’s future MIPS score? SA Ignite brings clarity to these questions and more in the following FAQ.

1. What is the Value-Based Payment Modifier?

The value-based payment modifier (VBM) program competitively rates Medicare Part B professionals on quality and cost measures to determine upward or downward payment adjustments to their Part B reimbursements (note: Part A hospital and Part C Medicare Advantage payments are not impacted by VBM). CMS designed VBM to be globally budget-neutral so that the national incentive pool equals the size of the penalty pool. Hence, high-performing professionals are in essence rewarded with dollars taken from low-performing professionals. For the 2015 performance year, the Part B payment adjustment ranges from a -4% penalty to a +4% incentive for provider groups with at least 10 eligible professionals (EPs), and is +/-2% for groups and solo practitioners with less than 10 EPs. EPs are professionals meeting the eligibility criteria of the Physician Quality Reporting System (PQRS) program.

VBM payment adjustments are applied to Part B payments paid to the provider group in the 2nd calendar year after the performance year. For example, quality and cost scores for the 2015 performance year lead to adjustments of Part B payments in 2017 to the provider group. CMS delivers a performance-year scorecard, known as a “Quality and Resource Use Report” or “QRUR”, in the Fall of the year after that performance year. In addition, provider-identifiable VBM payment adjustment performance and PQRS quality measures are or will be published to the CMS Physician Compare website (see FAQ # 5 below on reputational impacts of VBM) for consumers to view and 3rd-parties to download.

VBM quality and cost performance are determined on a group-by-group basis and tied to each provider group’s tax identification number (TIN) through which Part B payments are paid. VBM Quality and Cost Scores are based upon: (1) PQRS quality measures submitted by each provider group as a whole (group practice reporting option, or “GPRO”) or individual professionals belonging to the provider group, and (2) claims-based quality and cost measures spanning both Medicare Part A (inpatient) and Part B services for Medicare beneficiaries attributed to the provider group.

2. What provider groups are eligible for VBM?

For the 2015 performance year, all provider groups and solo practices each having at least 1 EP (or, equivalently, PQRS-eligible professional) is subject to VBM. EPs include both physicians and non-physicians for the purpose of counting how many EPs are billing Medicare Part B under a given group’s TIN.

The eligibility net of VBM has widened considerably over the last few years. Notably, 2015 is the first performance year in which provider groups and solo practitioners participating in the following CMS programs are now subject to VBM payment adjustments:

- Medicare Shared Savings Program (MSSP) accountable care organizations (ACOs),

- Pioneer ACO Model,

- CPC Initiative, and

- similar CMS Innovation Center models and CMS initiatives, as determined by CMS.

3. How does a provider group meet the minimum reporting requirements for VBM and thereby avoid an automatic penalty?

VBM essentially borrows from the PQRS program in setting minimum reporting requirements. In order to avoid an automatic VBM penalty, a provider group must do one of the following: (a) register and report as a PQRS GPRO for the group’s TIN, or (b) report at least 50% of the group’s EPs for PQRS on an individual-EP basis. Under option (a), registration with CMS for a PQRS GPRO reporting method, such as by registry or EHR, is due by June 30th of the performance year, and the declaration cannot be changed after the deadline. Note that there are no minimum reporting requirements with respect to VBM cost measures, as those measures are calculated by CMS based upon submitted Part B claims.

4. What are the financial impacts of VBM?

For the 2015 performance year, the automatic VBM penalty applied to provider groups not satisfying the minimum VBM reporting requirements outlined above in FAQ #3 is -4% for provider groups with at least 10 eligible professionals (EPs) and -2% for groups and solo practitioners with less than 10 EPs. This automatic penalty is in addition to the -2% assessed by the PQRS program, so that a total penalty of -6% is applied for non-PQRS-reporting groups having at least 10 EPs and -4% for groups and solo practitioners with fewer than 10 EPs.

Importantly, for the 2015 performance year, the payment adjustment will only be applied to physicians billing to the group’s TIN in the 2017 payment adjustment year. So although non-physicians count as EPs for the purpose of determining the size of a group and thereby the potential payment adjustments outlined in this FAQ #4, non-physicians’ 2017 Part B payments are not subject to VBM payment adjustments. However, CMS is proposing for the 2016 performance year for 2018 payment adjustments to apply to physicians and non-physicians alike.

Should the minimum VBM reporting requirements be met, all such provider groups and solo practitioners, as identified by TIN, receive Part B payment adjustments based on whether they are rated as “high, average, or low” on quality and cost dimensions relative to peers nationally. As reported on an organization’s annual QRUR report, a quality or cost score of equal to or less than -1.0 (one standard deviation below the national mean performance) is deemed “low”, between -1.0 and 1.0 is “average”, and equal to or above 1.0 is “high”.

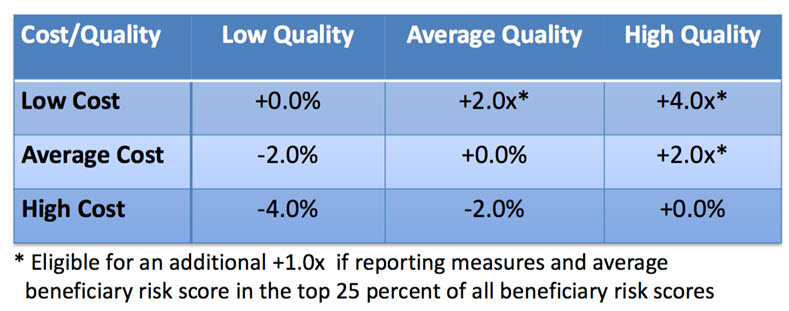

For a provider group with at least 10 EPs, the following payment adjustment table reflects the +/-4% range of payment adjustment for the 2015 performance year (to be applied to payments in 2017):

The “x” factor is a budget-neutrality factor designed to make the national VBM incentive pool equal to the assessed national VBM penalties, including those automatic penalties for non-PQRS-reporting entities. By way of example, for the 2013 performance year, x was 4.9% (from the CMS 2015 Value Modifier Program Experience Report), due to a significant number of non-PQRS-reporters. If for the 2015 performance year x were to reduce by half to 2.5%, due to greater compliance with the VBM minimum PQRS reporting requirements, then the maximum VBM incentive would be 4.0*2.5% = 10%. Under this scenario, an additional 1.0*2.5% = 2.5% would be awarded if the group’s average Medicare beneficiary cost-risk score were in the top 25% of all beneficiary cost-risk scores nationally.

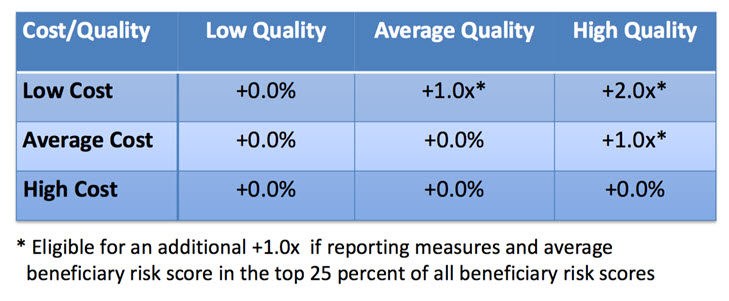

For a provider group or solo practice with fewer than 10 EPs, the following payment adjustment table reflects the +/-2% range of payment adjustment for the 2015 performance year (to be applied to payments in 2017):

Reference for payment adjustment tables – see slides 22-23

Reference for payment adjustment tables – see slides 22-23

5. What are the reputational impacts of VBM realized through the public reporting of performance to consumers?

Regarding the public reporting of VBM performance to consumers, CMS has proposed that provider groups earning VBM incentives for the 2016 performance year will each have a “green checkmark” next the group’s name on the CMS Physician Compare consumer website, indicating that the group earned a high-quality rating or low-cost rating and at least an average rating on the other rating, cost or quality, respectively. Furthermore, VBM amplifies penalties for groups not reporting PQRS, resulting in an increase in the volume of PQRS quality measure data available to be publicly reported by the PQRS program through the Physician Compare website.

All 2015 PQRS quality measures gathered through all reporting methods and for all groups and solo providers will be reported publicly through the Physician Compare website in a provider-identifiable way. Any third-party organization will be able to download the approximately 10 gigabyte zip file containing all the data to repurpose through their own website, such as how the Weather Channel or WeatherBug monetize weather data sourced freely from the National Weather Service. The reputational and consumer-choice impacts on provider organizations have the potential to dwarf the direct financial impacts of value-based payment modifier incentives and penalties.

This article was originally published on SA Ignite and is republished here with permission. Join HITECH Answers and SA Ignite for The ABCs of MIPS, a monthly webinar that addresses your questions on the current and future state of merit based provider payment systems. This informative one hour program has our experts covering the full spectrum of the payment program alphabet including MU, PQRS, VBM and more. See Our Events to learn more.