The changing healthcare environment, and what it means for health IT

The changing healthcare environment, and what it means for health IT

Robert Rowley, MD, Healthcare and health IT consultant, practicing family physician

Health care is changing. It is doing so in a profound, organizational way. I’m not talking about the advent of new technologies – diagnostics, therapeutics and information technology – I’m talking about how doctors and hospitals are organized.

The tradition in this country is that health care has been delivered mainly by individual, self-employed physicians or doctor-owned practices. The shift that is occurring is that these are being replaced by hospitals and health systems which employ (directly or indirectly) doctors into large clinics.

One hears anecdotes that in some areas of the country, one can find virtually no free-standing doctor’s offices; all are owned by one hospital system or another. Is there data to show this to be a trend nationally, or is it simply a local-market phenomenon in certain areas?

[Related Article: The Three Legs of Health IT]

There is now significant data that shows the trend toward consolidation over the past 15 or so years, and show how it is an enduring trend. Let us look at this data a couple of different ways, and then consider what this means for all those industry sectors (medical devices, pharmaceuticals and health IT) that service and support health care.

Solo and small group practices are being replaced by medium sized single-specialty groups

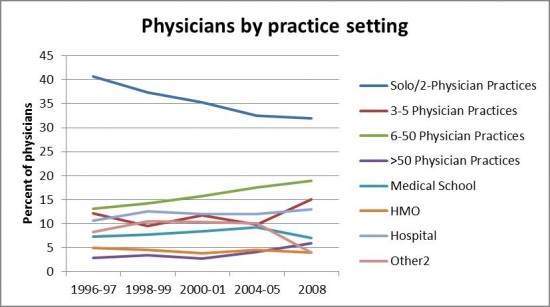

Data based on surveys conducted by the Center for Studying Health System Change (HSC) observed that physicians have been moving to mid-sized, single-specialty practices. An initial report showing data through 2005 was published by HSC, and a follow up publication showed these trends continuing through 2008.

The trends are dramatic when seen graphically:

Though the numbers of small and solo practices is declining – only one in three doctors are in these settings – there are still significant numbers here. Those companies that target their products to these smaller practices still have some runway here (as far as longevity in their business model is concerned), but the numbers are shrinking quickly. These smaller practices need to be supported, of course, but it may also represent “selling into a vanishing market” if the products are not adjusted to address the needs of larger practices, which are becoming the norm.

Practices are being absorbed into health systems

In addition to the trend among medical practices moving away from solo and small groups, there is also the trend of practices selling themselves to hospitals and health systems. This is not only true for new entrants into the job market, looking for stability and reliability of income, but it is also seen in established practices.

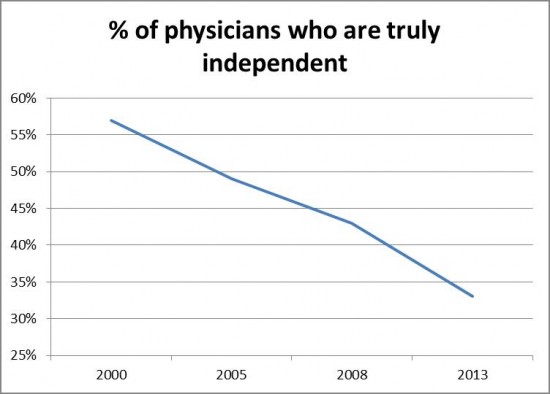

A report by Accenture in 2011 shows how community-based physicians, who previously had been in private groups, are increasingly selling their practices or seeking employment directly with healthcare systems. And hospitals are aggressively acquiring physicians to remain competitive in the industry.

The total number of physicians who are “truly independent” has steadily been declining by 2% annually, and is projected to decline to 5% annually by 2013 – at which time, only 33% of physicians will be independent; the rest will be employed by larger healthcare systems:

Of course, the reasons for this trend are numerous. From the physician perspective, physician employment offers the advantages of (1) relief from administrative responsibilities; (2) greater access to top-shelf health IT tools, facilities and equipment; (3) more manageable work week (typically sought by recent trainees); and (4) stability in the business environment made uncertain by things like payment reform.

These counterbalance the traditional values of independence, non-alignment, and entrepreneurialism. These values are core to medicine, but the numbers indicate that the advantages of being employed by a health system are more important.

As noted in the Accenture report, there is a proliferation of alignment models. Numerous physician-led alignment models serve as alternatives to direct employment of doctors by hospitals. Examples include the physician-hospital organization (PHO) and the independent practice association (IPA). Moreover, under healthcare payment reform, a clinically integrated accountable care organizations (ACO) allow collective contracting without the need for employment by a single entity. Proliferation of these models could preserve physicians’ independence. In fact, as noted previously, very-large ACOs (in the 2000-3000 physician range) have been seen in areas where most physicians have a system-alignment; smaller ones (in the dozens-to-few hundreds) are seen elsewhere.

What this means for health IT

Health IT, like many other areas of U.S. business development, has been a mix of large, traditional companies (with little need for making disruptive changes) and smaller start-ups that challenge the foundations of the industry. Sometimes, the smaller start-ups are successful, though many are not.

EHR companies that focus on small practices need to prepare for the shifting groundswell of health care towards more integrated and coordinated delivery environments. Larger, established companies who cater to hospitals and health systems feel little need to change, since their market expands as a function of hospital and health system acquisition of previously small and independent medical practices.

[Related Article: EHR Market Ripe for Consolidation]

Do smaller health IT companies have the wherewithal (=bandwidth, =funding) to develop sufficiently sophisticated products needed to compete with the large hospital-based vendors? That will be their challenge. Failure to address these changes will result in attrition of use of their products, as physicians who used to be small and independent now sell their practices to health systems, and replace their previous small-scale health IT with large enterprise-addressing systems. That will be where the market is tested, in the next 2 years.

Robert Rowley is a practicing family physician and healthcare information technology consultant. From its inception through 2012, Dr. Rowley had been Practice Fusion’s Chief Medical Officer, having created the underlying technology in his own practice, and using that as the original foundation of the Practice Fusion web-based EHR. This article was first published on Dr. Rowley’s web site www.robertrowleymd.com.