By Sara R. Collins, VP, Health Care Coverage and Access and David Blumenthal, M.D., President, The Commonwealth Fund

By Sara R. Collins, VP, Health Care Coverage and Access and David Blumenthal, M.D., President, The Commonwealth Fund

Twitter: @CommonwealthFnd

New estimates released by the Centers for Medicaid and Medicare Services (CMS) show that annual growth in U.S. health care spending increased to 5.3 percent in 2014, up from 2.9 percent in 2013, after five consecutive years of historically low growth¹. The increase was driven in part by the fact that 8.7 million more Americans had health insurance in 2014 under the coverage expansions of the Affordable Care Act and used their insurance to get care. The other significant driver of spending was rapid growth in prescription drug spending, reflecting in part the introduction of new and expensive hepatitis C drugs. In this post, we take a look at both factors.

How the Affordable Care Act Is Affecting Health Care Spending

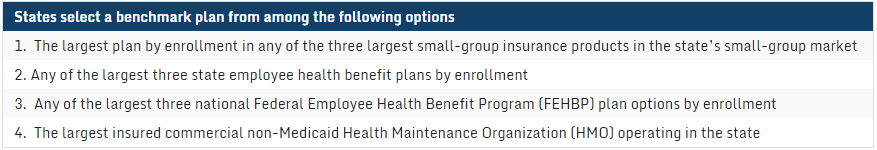

The Affordable Care Act increased the share of Americans with health insurance to nearly 89 percent in 2014, the highest coverage rate since 1987. People gained coverage principally through private insurance sold through the state marketplaces and expanded eligibility for Medicaid. As people with new coverage gained more affordable access to health care, spending in both private insurance and Medicaid grew.

Growth in per-enrollee private insurance spending remains lower than prior years. While growth in total private insurance spending was higher in 2014 than in 2013, the rate of growth was the same or only slightly higher than in prior years, when the number of privately insured Americans was actually falling. For example, total private insurance spending rose 4.4 percent in 2014, up from 1.6 percent in 2013, as enrollment climbed by 1.2 percent. In contrast, from 2008 to 2011, private insurance enrollment was falling (by as much as -3.2 percent in 2009) while spending was growing from 3.5 to 4.6 percent per year. Consequently, per-enrollee spending growth in 2014 (3.2%) was lower than in prior years, when it ranged from 4.5 percent to 6.9 percent.

Consumers were better off in 2014. The CMS report shows that expanded coverage through both private insurance and Medicaid is lowering out-of-pocket spending for consumers. Household spending on health care costs such as copays, deductibles, coinsurance, and spending on uncovered services slowed somewhat, from 2.1 percent in 2013 to 1.3 percent in 2014 (Exhibit 1). This was chiefly the result of fewer uninsured people; many of the newly covered would have previously paid the full cost of services. It’s not clear whether privately insured people also reduced health care use, and thus lowered their out-of-pocket spending, because of high deductibles documented in other recent research².

Exhibit 1. Out-of-Pocket Expenditures, 2013 and 2014

Spending on hospital services was a particularly big-ticket item for uninsured families prior to the Affordable Care Act. Today, fewer people are paying the full cost of hospital stays because of the coverage expansions. In 2014, out-of-pocket spending on hospital services declined by 4.1 percent, down from an increase of 4.7 percent in 2013.

In contrast, out-of-pocket spending on prescription drugs climbed by 2.7 percent, up from a decline of 3.7 percent in 2013.

Growth in per-enrollee Medicaid spending fell in 2014. Total expenditures in Medicaid climbed by 11 percent in 2014, up from 5.9 percent in 2013, as enrollment in the expanded program jumped by 13.2 percent. But per-enrollee Medicaid spending actually declined by 2 percent in 2014, after climbing in 2013 by 4.1 percent. This is because people who gained coverage through the ACA’s Medicaid expansion tend to be healthier than those previously enrolled, many of whom were eligible because of a disability or old age.

Highly Priced Specialty Drugs Are Increasing Prescription Drug Spending

Between 2007 and 2013, annual increases in spending on prescription drugs averaged 0 percent, in part because a number of commonly used medications came off patent during this period and were replaced by much less expensive generic medications³. In addition, there was a lull in the introduction of new, expensive branded drugs. In 2014, this situation changed dramatically: Spending increased 12.2 percent over 2013 levels. A major driver was the availability of a number of extremely high-priced and effective medications such as new drugs to treat hepatitis C, a chronic liver infection that causes liver failure and liver cancer. In 2014 Americans spent $11.3 billion on hepatitis C drugs alone, which constituted 7 percent of the $151 billion in increased overall spending and about one-third of the $32.4 billion in increased spending on prescription drugs. A fall-off in patent expirations and dramatic price increases for some existing drugs also contributed to the prescription drug jump.

Forthcoming scientific breakthroughs are likely to fuel drug spending for some time to come, though some powerful and effective new agents may reduce future costs for other kinds of care.

Looking Forward

Increases in rates of health care spending are always concerning in a country that is already spending more than 17 percent of its GDP on health care and twice as much per capita as any other nation. If 2014 trends persist, they will demand renewed and intense focus on ways to reduce waste and improve the efficiency of services while maintaining or improving quality. In this regard, the pharmaceutical sector deserves special attention because of market distortions that are dramatically increasing prices for existing medications, including common generic drugs, and because of peculiarities of patent law that enable some companies to extend patent protections well beyond usual periods.

However, it is unrealistic not to expect some uptick in health spending in association with providing health insurance to millions more Americans, including many who are receiving highly cost-effective care to prevent illness and stabilize chronic conditions. It will be critical going forward to distinguish between new spending that is wasteful and unnecessary and new spending that constitutes a wise investment in the health, welfare, and productivity of Americans.

This article was originally published on the Commonwealth Fund Blog. For research notes and links from this article, refer to the original source.