By Vince Kuraitis JD/MBA, Principal, Better Health Technologies, LLC

By Vince Kuraitis JD/MBA, Principal, Better Health Technologies, LLC

LinkedIn: Vince Kuraitis

AI adoption in healthcare is facing “The Point Solution Paradox”. This paradox highlights the intricate balance between the necessity of point solutions in the evolution of AI in healthcare and the challenges they pose in an already fragmented industry.

Here’s a roadmap to this post:

- Investment and innovation have been dynamic, but adoption lags

- A 3-phase framework for AI adoption

- The Point Solution Paradox

- Care providers prefer integrated solutions

- A case study of The Point Solution Paradox: medical imaging

- How will The Point Solution Paradox play out in healthcare?

- Conclusion

This blog post is the first in an occasional series examining the synergies between AI and platforms.

Investment and Innovation have Been Dynamic, But Adoption Lags

The digital health landscape has been dynamic. A 2023 report by FINN Partners and Galen Growth documented that there are over 9,000 digital health ventures worldwide. An analysis by Tracxn estimated that there are over 3,147 AI startups in healthcare in the United States alone.

However, the adoption of AI in healthcare has lagged for varied reasons. For example, an August 2023 report by Bain and Company found that only 6% of health systems have a generative AI strategy.

Thus, a pivotal question arises: How will future AI adoption unfold in healthcare?

A 3-Phase Framework for AI Adoption

The book “Power and Prediction” provides an excellent framework for understanding adoption patterns of general-purpose technologies (e.g., steam, electricity, the Internet, AI).

The authors explain that there are three phases in which all general-purpose technologies are adopted; these phases take decades to play out. They label and define the three phases as:

- Phase 1) Point solutions. A point solution improves an existing procedure and can be adopted independently, without changing the system in which it is embedded.

- Phase 2) Application solutions. An application solution enables a new procedure that can be adopted independently, without changing the system in which it is embedded.

- Phase 3) System solutions. A system solution improves existing procedures or enables new procedures by changing dependent procedures.

The Point Solution Paradox

What is The Point Solution Paradox?

On the one hand, point solutions are a necessary first step in the broader adoption of any general-purpose technology. And…there are many circumstances where point solutions are appropriate.

On the other hand, healthcare is already extremely fragmented and siloed. There already are too many point solution offerings. These include digital health startup offerings fueled by a decade of easily available capital as well as applications developed by incumbent companies. Thus, in the short to medium term, AI point solutions in healthcare can be uniquely problematic — they add to the fragmentation of healthcare and are a tough sell to customers.

Care Providers Prefer Integrated Solutions

Even before the advent of AI, health systems have been drowning in point solutions.

In 2023, symplr surveyed health system clinicians and IT/CIOs. They found that the majority (55%) of respondents still use between 50 and 500+ software solutions to run their organization’s healthcare operations. 80% agreed that working with disparate IT systems complicates their job.

A central finding of the survey was that “Clinicians invest an excessive amount of time navigating a complex array of technology systems, leaving them with insufficient opportunities to focus on their primary role: providing patient care…”

A Case Study of “The Point Solution Paradox”: Medical Imaging

Radiological imaging is the “canary in the coal mine” to illustrate The Point Solution Paradox.

Medical imaging was expected to be one of the first areas of adoption of AI in healthcare:

- Radiological images are highly standardized. The DICOM standard dates back to 1993.

- Radiology has a well-established, highly structured workflow.

- Image reporting is highly standardized

- Large data sets have been available to develop AI algorithms

- Imaging was viewed as particularly suited for deep learning

In 2016, Turing Award winner Geoffry Hinton proclaimed: “People should stop training radiologists now…If you work as a radiologist, you are like the coyote that’s already over the edge of the cliff but hasn’t yet looked down.”

Investment and innovation in medical imaging and radiology has flourished. An analysis by GlobalData found that “there are 870+ companies, spanning technology vendors, established technology companies, and up-and-coming start-ups engaged in the development and application of AI-assisted radiology.”

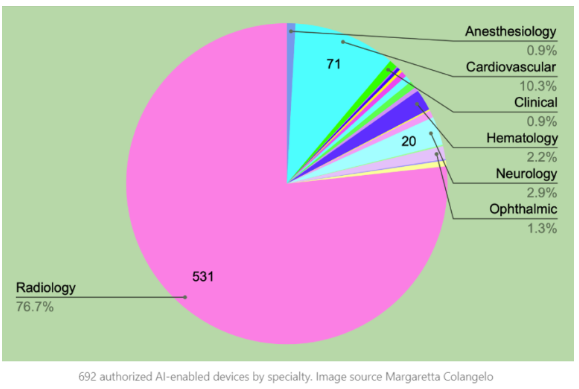

As of October 2023, the FDA has authorized 692 AI/ML enabled medical device algorithms – the vast majority of which are point solutions. The diagram below from Margaretta Colangelo shows that 76.7% of these FDA-approved algorithms are in radiology; the next closest area is cardiovascular — with 10.3% of approvals — many of which are specific to cardiac imaging.

Despite high levels of investment and innovation, the adoption of AI in imaging and radiology has been much slower than anticipated.

A 2023 Advisory Board study examined the status of AI in radiology:

- Percentage of providers using at least one AI tool:

- Hospitals – 53%

- Radiology groups – 33% (i.e., 2/3 of groups aren’t yet using AI)

- Among AI users, they had adopted an average of 3 products

An article in the May 25, 2023 issue of the New England Journal of Medicine found that the current penetration of AI in the U.S. radiology market is estimated to be only 2%. Despite the initial excitement about AI adoption in imaging, the promise has yet to be realized.

How will “The Point Solution Paradox” Play Out in Healthcare?

The resolution of this paradox is not straightforward and will take time — there are no easy answers. The purpose of this article is more to create awareness of the paradox, rather than to prescribe solutions. And as previously noted, there are many reasons why AI penetration in healthcare has lagged.

AI platforms will increasingly become a more viable option for purchasers. Examples include AIdoc for clinical applications and LeanTaaS for administrative/operational applications.

EHR platforms also are incorporating AI applications. For example, Epic is working on 60 generative AI projects.

However, EHRs are prioritizing operational/administrative AI algorithms. ONC’s AI transparency requirements likely will make EHRs wary of creating or incorporating AI algorithms for direct clinical diagnosis and prescribing – regulatory requirements, liability concerns, and security/privacy risks will be much higher. Again using radiology as an example, today, only 22 products meet the American College of Radiology’s (ACR’s) requirements for “Transparent-AI”. (Admittedly, the ACR requirements differ from the ONC requirements for AI transparency.)

It’s also likely that incumbent tech, device, and pharma companies over time will offer more integrated AI applications. In radiology, keep an eye on companies such as GE Healthcare, Canon, Siemens, and Philips.

Early-stage companies will need to reevaluate their point solution offerings. Many will become insolvent. Others will be acquired by companies with broader AI platforms.

Conclusion

Referring back to the Power and Prediction 3-phase framework, the evolution of AI from point solutions to application solutions to system solutions will take longer in healthcare than in other industries.

To end on a positive note, AI offers incredible promise in healthcare. History will show that AI contributed more to mankind in healthcare transformation than in any other industry!

This article was originally published on The Healthcare Platform Blog and is republished here with permission.