Consumer products, HIM companies lead Health IT funding and acquisitions

Consumer products, HIM companies lead Health IT funding and acquisitions

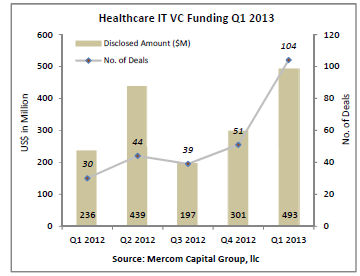

Investor relations and market intelligence firm Mercom Capital Group has released its Q1 2013 report on funding and mergers and acquisitions activity for the health IT sector. The report shows venture capital funding in the industry continuing an upward trajectory with $493 million raised for 104 funding deals, doubling from the previous quarter. The report also shows 42 early stage funding deals in play this quarter. And what kinds of companies are seeing all this funding? Activity shows VC interest in consumer-based health products and services is on the rise.

“The trend we began to see last year of VCs investing in consumer-focused companies like mobile health, telehealth, personal health, social health, and scheduling, rating & shopping has become much more pronounced,” commented Raj Prabhu, CEO of Mercom Capital Group. “The enormous market opportunity in consumer-focused health has appeared to pique the interest of investors and is likely to continue to grow as witnessed by the surge in VC activity.”

The Top 5 VC funding deals in Q1 2013 were as follows:

- $41 million raised by Health Catalyst, a provider of healthcare data warehousing

- $40 million raised by xG Health Solutions, a spinoff of Geisinger Health System that offers population health data analytics and patient and population-focused care management

- $31 million raised by NantHealth, a company focused on delivering next-generation care through the use of advanced secure fiber networks, cloud computing and wireless mobile technology

- $30 million raised by Fitbit, a fitness and health tracker company

- $30 million raised by One Medical Group, a provider of online primary care services

On the mergers & acquistions front there were 46 transactions in Q1. Health Information Management (HIM) companies saw the greatest activity in the health IT sector with 22 transactions. The largest disclosed transaction was athenahealth’s acquisition of Epocrates, a mobile health company developing point-of-care medical applications, for $293 million. This was followed by Allscripts’ acquisition of dbMotion, an architecture-based interoperability platform, for $235 million.