By Anshu Jindal, COO, MyMipsScore

By Anshu Jindal, COO, MyMipsScore

Twitter: @MyMipsScore

The MACRA 2018 Final Rule for year-two of Quality Payment Program was released recently. Some changes were retained from the 2018 proposed rule, some were deferred till 2019, while in some cases the approach outlined in the 2017 Final Rule was adopted instead. That being said, let us reiterate the eligibility criteria, go through some new bonus opportunities, exception criteria, and take a look at how the changes in Performance Thresholds impact the payment adjustments in 2020 based on performance in 2018.

Eligibility and Payment Adjustments

MIPS Eligible Clinicians in 2018

The following clinicians are covered under MIPS provided they exceed the Low Volume Threshold at the individual or group level (if reporting as a group), are not newly enrolled in Medicare, and do not qualify as QP or partial QP under an Advanced APM. No additional eligible clinician types have been added for performance year 2018.

- Doctors of Medicine (MD)

- Doctors of Osteopathy (DO)

- Doctors of Dental Surgery/Dental Medicine (DMD/DDS)

- Doctors of Podiatry (DPM)

- Doctors of Optometry (OD)

- Chiropractors (DC)

- Physician Assistants (PA)

- Nurse Practitioners (NP)

- Clinical Nurse Specialists (CNS)

- Certified Registered Nurse Anesthetists (CNA)

Low Volume Threshold

The low volume threshold has been significantly increased to reduce the burden on small practices. Both parts of the threshold must be crossed for a clinician to be included in MIPS. That is, the eligible clinicians must bill more than $90,000 in Medicare Part B allowed charges AND provide care to more than 200 Medicare Part B beneficiaries. If an eligible clinician doesn’t meet both the criteria, s/he is exempt from MIPS.

Test Pace Option Not Available

Before we move on to understanding the new Performance Thresholds for 2018, it is vital to understand that the Test Pace option will no longer be available in 2018 for MIPS reporting. Full year reporting (Jan 1, 2018 – Dec 31, 2018) will be required for Quality and Cost categories; whereas, for ACI and IA categories, any 90 continuous days of data within the calendar year 2018 can be reported.

Thresholds for Calculating Payment Adjustment

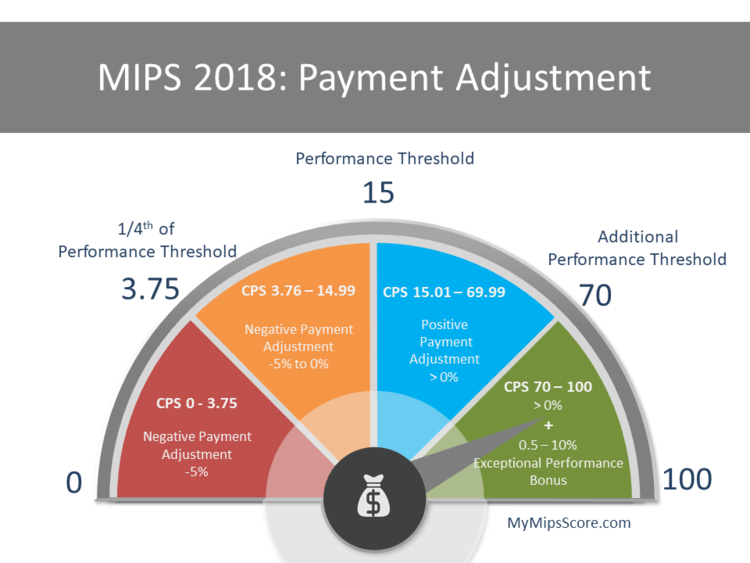

The Performance Threshold for earning neutral payment adjustment has been increased from 3 points in 2017 to 15 points in 2018, whereas the Additional Performance Threshold will stay the same at 70 points. Although the numbers have changed, the basic logic of payment adjustment calculation including how the scaling factors would work to determine fair distribution stay the same. The two components of payment adjustment also stay the same – Budget-Neutral Component and the Exceptional Performance Component.

Base Payment Adjustment Range: +/- 5%

Base Payment Adjustment Range: +/- 5%

For MIPS Score 0 to 3.75 Points: Full penalty of -5% is applicable. According to the MACRA final rule, full penalty determined for the performance year applies if the score is at or below ¼th of the Performance Threshold for that year (15 x ¼ = 3.75). This is the only number that can be claimed with certainty.

For MIPS Score 3.76 – 14.99 Points: Negative payment adjustment gradually decreasing on a linear sliding scale from -5% to < 0% will apply

For MIPS Score of 15 Points: Payment adjustment of 0%

For MIPS Score 15.01 – 69.99 Points: Providers will receive the budget-neutral component of positive payment adjustment which is scaled from 0% to 5% (scaled to provide maximum adjustment at MIPS score of 100). A scaling factor (up to a max of 3) will be used to equitably distribute every single cent of the penalties collected. It means that there is a potential to earn a up to 15% (5% x 3 = 15) in budget neutral component of positive adjustment, provided there is enough money collected as penalties.

For MIPS Score 70 – 100 Points: Budget-Neutral + Exceptional Performance Payment Adjustment The providers whose score lie in this range will not only earn the budget-neutral payment adjustment, but will also earn an additional exceptional performance positive payment adjustment. This bonus will be given out from $500 million annual budget starting at +0.5% for MIPS score of 70, up to a max of +10% for a MIPS score of 100. Another scaling factor will be utilized to ensure a fair distribution of the monies, i.e. more money for a higher score and stay within the annual budget of $500 million.

Medicare Part B and Payment Adjustments: If Medicare Part B Drugs constitute a substantial part of your Medicare billing, please know that the charges billed for these drugs and costs for administering the drugs will be included under MIPS payment adjustments for both 2017 and 2018. This means more money in positive payment adjustments for the specialties that do administer such drugs. Take a look at the fact sheet CMS has put together explaining how Medicare Part B drugs will impact the payment adjustments.

Overarching Changes

Small Practice Bonus

Small practices (with 1 – 15 eligible clinicians) will be awarded 5 additional points towards the final MIPS score E.g. For a small practice, a MIPS score of 65 will become 70 (65+5). This bonus will be awarded only if the MIPS eligible clinician submits data for at least 1 performance category for the performance year 2018. (No submission required for the Cost category)

The definition of small practice has been modified in Final Rule 2018. It now refers to practices consisting of 1-15 eligible clinicians (refer to the included clinician types listed above).

Self-Identification Not Required For Small Practices

CMS will utilize historical claims data spanning over a period of 12 months to make small practice determinations. CMS will base it on the number of NPIs who are MIPS eligible clinicians billing under one TIN.

Complex Patient Bonus

MIPS Eligible Clinicians, Groups, MIPS – APM Entities, and Virtual Groups can earn up to 5 bonus points towards their final MIPS score for the treatment of complex patients, provided they submit data for at least one performance category. This bonus would be determined based on a combination of the Hierarchical Condition Categories (HCCs) and the number of Dually Eligible patients treated.

Improvement Scoring For Quality and Cost

For 2018, the improvement scoring will be measured at the performance category level for Quality category. For the Cost category, it will be based on statistically significant performance improvement at the measure level. If Improvement Score can’t be calculated due to insufficient data, an Improvement Score of 0 percentage points will be assigned for that performance category. For instance, if a clinician reports using the same identifier (TIN/NPI) on the same cost measures for two consecutive performance periods, only then can the improvement be determined. The bonus percentage points that can be earned under Improvement Scoring differ for Quality and Cost performance categories:

- Up to 10 percentage points could be earned for the Quality performance category

- Up to 1 percentage points could be earned for the Cost performance category

Virtual Groups

A Virtual Group is a combination of two or more Taxpayer Identification Numbers (TINs) made up of solo practitioners and groups of 10 or fewer eligible clinicians who come together “virtually” (irrespective of specialty or location) to participate in MIPS for a performance period of a year. However, each TIN (solo practitioner or a group) will need to exceed the low volume threshold to be eligible to form a virtual group. CMS has put together a 2018 Virtual Groups Toolkit for small practices to get started on the process. The election deadline to participate in 2018 is Dec 31, 2017. [Read more about Virtual Groups]

2014 Edition Certified EHR Allowed

Providers can still use 2014 edition CEHRT to capture and report the data for MIPS 2018; but a bonus of 10% will be awarded towards ACI category score for exclusively using the 2015 certified edition to report for performance year 2018. Additionally, MIPS eligible clinicians whose EHR was decertified could also apply for exception from reporting under ACI performance category.

Additional Flexibility For Clinicians Impacted By Extreme and Uncontrollable Circumstances

Beginning 2018 performance year, the impacted clinicians can claim the hardship exception for all the performance categories – Quality, Cost, Improvement Activities, and Advancing Care Information performance categories. This hardship exception application deadline is December 31, 2018.

2017 – Special Considerations

To provide relief to clinicians impacted by hurricanes Irma, Harvey and Maria and other natural disasters in 2017, an interim final rule allows for clinicians to be exempt from all the performance categories without submitting a hardship exception application. All the performance categories will be weighted to 0% for the clinicians affected by the said disasters.

Additionally, neutral payment adjustment will apply to their NPI/TINs for 2017 performance year. This applies to individual submissions (not group submissions), but CMS will ensure that all individuals in the affected areas will be protected from negative payment adjustment for the 2017 MIPS performance period.

However, the clinicians who do submit the data for one or more performance categories, would be scored as per normal scoring standards for 2017. They can still submit hardship exception for ACI if they didn’t have access to their EHR due to uncontrollable circumstances, and their ACI category weight will be allocated to the Quality category. The deadline to submit ACI hardship exception has been extended to Dec 31, 2017.

Category Specific Changes

In the 2018 final rule, substantial updates have been made to all the performance categories that we will discuss in detail in future blogs. We already took a close look at the Cost performance category which will account for 10% of the MIPS score in 2018. We also talked about some new exceptions that will be available under ACI category, including the hardship exception for clinicians impacted by natural disasters. Next, we will take a look at the Quality category which account for 50% of the weight, the ACI category, and the Improvement Activities.

Stay tuned.

This article was originally published on MyMipsScore and is republished here with permission.