By Summer Humphreys, Principal Consultant, VisiQuate

By Summer Humphreys, Principal Consultant, VisiQuate

Twitter: @VisiQuate

Patient health hasn’t been the only thing that was hit hard (and continues to feel residual effects) during the COVID-19 pandemic. Numerous reports such as this one have shown that healthcare organization revenue also suffered dramatically since mid-March. Drivers of this revenue loss included providers shutting down portions of their operations and redirecting staff to prepare for the surge, recommendations by CMS to delay non-essential procedures and patients delaying care for all but the most urgent matters out of fear of acquiring the virus.

The challenge with the data to date is that while it confirms that things were bad, it doesn’t really show why. It is the patient care equivalent of saying “a lot of people were sick” without identifying any specific conditions or diseases. When information is that general, it is difficult to understand what to do first to get revenue back on track.

This is where applying one of the core principles of population health management – care management – can help. By digging more deeply into the data, revenue cycle managers can identify which departments were “sickest” during the COVID-19 pandemic (i.e., under-performing financial expectations based on historical performance from prior years) and which ones will benefit most immediately from targeted interventions. They can then use those insights to develop a game plan to begin recovering revenue and improve the overall performance of their revenue cycle.

Cumulative effect

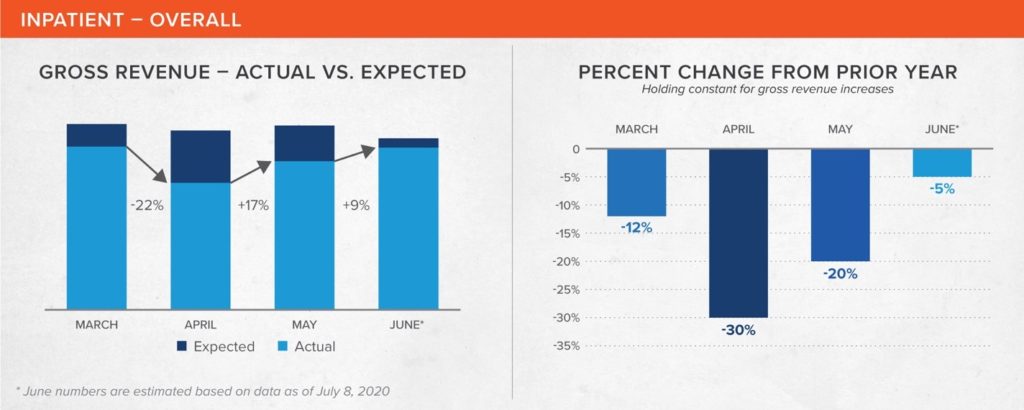

According to an analysis of financial data from more than 100 hospitals across the U.S. that was then extrapolated to the nation and adjusted for inflation and year-over-year charge increases, short-term acute care hospitals may have lost an estimated $325 billion+ in gross revenue versus expectations between March and June.

A closer look at this data shows inpatient revenue fell by nearly $120 billion as compared to historically adjusted levels, while outpatient revenue is behind by more than $207 billion. It’s when you start drilling down further, however, that more detailed patterns begin to emerge that enable revenue cycle managers to offer strong guidance to C-suite executives on where the pent-up demand lies. They can then use this information to prioritize their reopening efforts.

Inpatient revenue

Overall, inpatient revenue was hardest hit in April, falling 30% year-over-year. It has continued to improve since then, and is estimated to be only 6% under the expected gross revenue for June.

Overall, inpatient revenue was hardest hit in April, falling 30% year-over-year. It has continued to improve since then, and is estimated to be only 6% under the expected gross revenue for June.

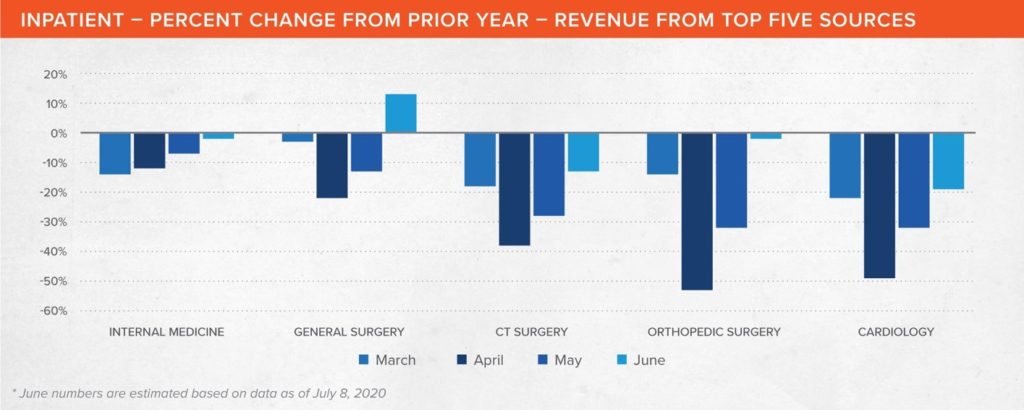

Internal medicine cases, i.e. those under the primary care of a hospitalist or an intensivist, typically account for about 20% of hospital inpatient revenue contribution – the largest single portion – so it might be tempting to start there. The reality, however, is that internal medicine felt relatively few effects from the pandemic in terms of revenue, likely because of the severity of illness of many of these patients, and also because this patient population would include COVID-19 cases. It fell only 12% year-over-year in April and 7% in May and is expected to be at or even slightly above historical levels in June.

Internal medicine cases, i.e. those under the primary care of a hospitalist or an intensivist, typically account for about 20% of hospital inpatient revenue contribution – the largest single portion – so it might be tempting to start there. The reality, however, is that internal medicine felt relatively few effects from the pandemic in terms of revenue, likely because of the severity of illness of many of these patients, and also because this patient population would include COVID-19 cases. It fell only 12% year-over-year in April and 7% in May and is expected to be at or even slightly above historical levels in June.

The analysis did confirm, however, what was being reported anecdotally: a sizeable portion of hospital revenue loss came as the result of the postponement of non-emergent (“elective”) surgeries. Cardiac and thoracic surgery (CT Surgery) revenue was down 38% year-over-year in April and 28% in May and is expected to continue to lag by 13% in June. Meanwhile, orthopedic surgery was down 53% in April, 32% in May, but is expected to lag by only 2% in June.

Quite a few of these surgeries are bread-and-butter procedures in a hospital, i.e., they are high-profit, can be performed quickly and have lower risk. Focusing on getting patients back in for these surgeries – which includes convincing them that they now have little likelihood of acquiring COVID-19 while in the hospital – can help get revenue back on-track.

One other area where there is significant opportunity is cardiology, which saw a drop of 49% in April, 32% in May and an estimated 19% in June versus 2019. This is understandable given that patients with conditions such as chronic heart failure are among the most vulnerable to the severe effects of COVID-19. Yet their conditions do not stop because there is a pandemic.

Convincing these patients that they should come in for care now, before their conditions deteriorate any further, will pay both health and revenue dividends in the short- and long-term.

Outpatient revenue

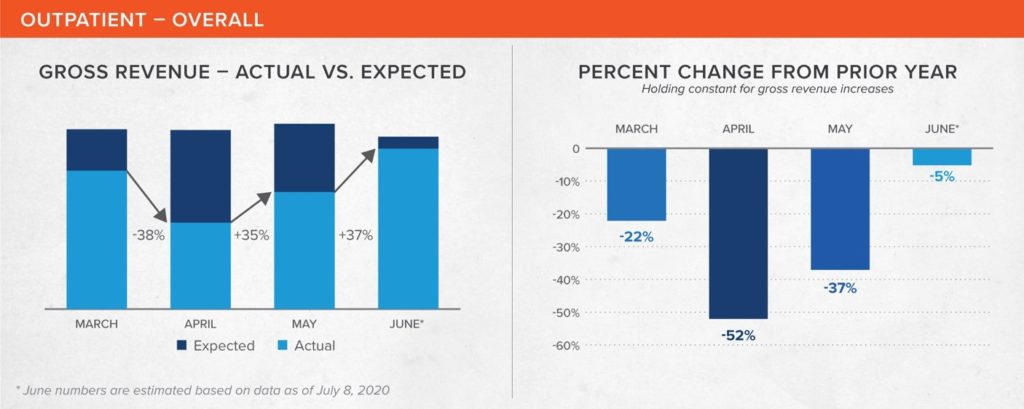

Outpatient revenue suffered significantly more than inpatient revenue, dropping 52% year-over-year in April. But things recovered quickly and by June it is estimated that revenue will have come within 7% of expected gross revenue. Increasing use of telemedicine and virtual visits has helped to both prevent greater losses as well as aid in the recovery.

Outpatient revenue suffered significantly more than inpatient revenue, dropping 52% year-over-year in April. But things recovered quickly and by June it is estimated that revenue will have come within 7% of expected gross revenue. Increasing use of telemedicine and virtual visits has helped to both prevent greater losses as well as aid in the recovery.

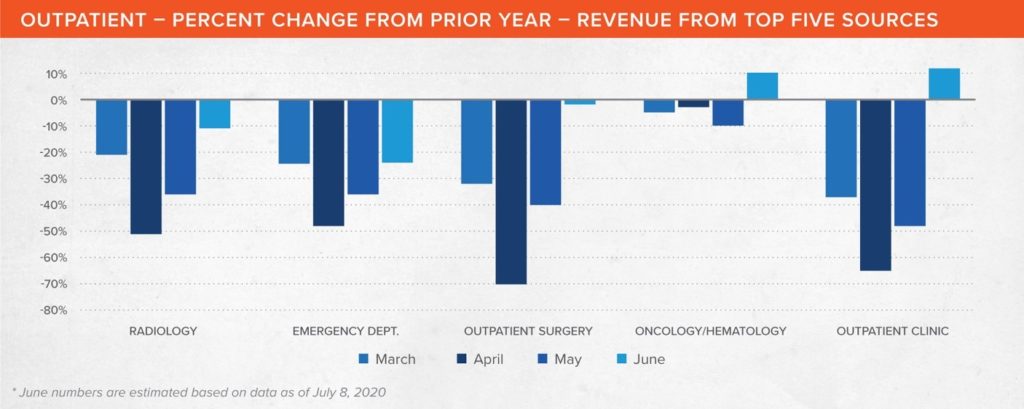

On the outpatient side, radiology can be the single largest contributor to hospital revenue. It was also one of the hardest hit by the pandemic. The analysis shows radiology revenue fell by 51% in April and was still down 36% for May. The June estimate indicates it is slowly coming back, but still lags previous year performance by 11%. A concerted effort should be made to bring patients in for routine mammograms, CT screenings and other radiology-related tests and procedures that can be easily executed on a large scale.

On the outpatient side, radiology can be the single largest contributor to hospital revenue. It was also one of the hardest hit by the pandemic. The analysis shows radiology revenue fell by 51% in April and was still down 36% for May. The June estimate indicates it is slowly coming back, but still lags previous year performance by 11%. A concerted effort should be made to bring patients in for routine mammograms, CT screenings and other radiology-related tests and procedures that can be easily executed on a large scale.

One surprise the data offered was in emergency department (ED) usage. While many who suspected they might have COVID-19 likely went to the ED first, apparently many others – especially those who use the ED for primary care – did not. ED revenue was down 48% in April, 36% in May, and is still behind 24% year-over-year in June.

While there has been a lot of discussion about reducing ED visits as part of a value-based care approach, most hospitals are not ready for such a precipitous drop yet. An effort to convince the community that the ED is safe for non-COVID-19 care, which includes explaining the precautions being taken to prevent the spread of the virus, will help convince patients that they can return for appropriate care which will return revenue to projected levels.

Outpatient surgery is another area for focus. It was down an astonishing 70% in April amid fears of contracting COVID-19, and still lagged by 40% in May. While the gap began closing in June, which only saw a lag of 3% versus 2019, there is still tremendous pent-up demand that hasn’t been tapped.

Oncology services have remained relatively stable, as cancer patients have generally continued treatments. April was down only 3%, May dipped a bit further to 10% year-over-year, but June rebounded and is estimated to be 10% higher than 2019. Given the downturn in diagnostic imaging studies performed, however, oncology could be headed for a future slide as the identification of new malignancies has been delayed.

Road to recovery

In population health management, closing the most important care gaps through timely care management is key to improving the health of populations and individuals. The same principles hold true with the revenue cycle.

Hospitals need to be proactive in taking action to bring revenue back. Here are some recommended steps to improve the current revenue stream:

- Promote telemedicine visits wherever possible – By encouraging providers and patients to stay engaged virtually, potential issues can be caught earlier and treated instead of getting worse until the patient can visit in person.

- Utilize analytics to target high-risk patients – Starting an outreach and support campaign to connect with those patients that are both most vulnerable as well as those dealing with chronic conditions can prevent unnecessary future emergent hospitalizations and ensure that population receives needed care in appropriately appointed settings.

- Reschedule cancelled procedures – Review cancellations in hardest hit areas, and work to reschedule patients where safety precautions allow. Reallocate staff to work through the backlog.

- Accelerate cash flow – Apply analytics, AI and machine learning to surgically identify hidden areas of actionable opportunity in existing accounts receivable to quickly add cash to the balance sheet.

- Deploy resources to the maximum benefit – Just as clinical staff may transform to best attend to varying patient care needs, operational staff should also shift to assist in the areas that will bring the most financial support.

By understanding where the greatest opportunities lie to generate immediate, substantial revenue, hospitals can give their revenue cycle a little care management so they can close their reimbursement gaps and create a faster return to stable financial ground.